Secured Loans

We understand the challenges associated with borrowing for many Christian communities. From assessing loan serviceability to the specialised nature of the church property, there can be many obstacles to overcome. That’s why CCFS can help you with your project. Whether its for the purchase of a new property or church manse, renovating or upgrading, contact CCFS to discuss the options available to you.

- No loan application fee or on-going fees

- Competitive interest rates

- Monthly principal and interest repayments

- loan terms of up to 20 years

- Offset accounts are available to reduce interest costs

- Loan rates are variable with interest calculated daily and charged monthly.

Easy Access Account

A fee-free* everyday account that can have cheque, BPAY, direct entry and online access (via CCFS Online). Investments can be made at any Australia Post branch that offers Bank@Post facilities with your pre-coded investment slip.

- No minimum investment amount required

- No fixed term, your money is available when needed

- Attractive interest rates

- No account keeping or account transaction fees*

- Interest calculated daily, credited 6 monthly

Online Accumulator Account

A fee-free* higher interest cash management account linked to your Easy Access Account that enables you to ‘park’ surplus funds. This account is only accessible via CCFS Online with transfers to and from your Easy Access Account. This account is not intended to be a transactional account. It is intended to be a place to invest surplus funds or funds that might accumulate over time for a mission’s project, building project or until funds are needed for operations.

- No minimum investment amount required

- No fixed term, your money is available when needed

- Higher interest rates

- No account keeping or account transaction fees*

- Interest calculated daily, credited 6 monthly

Term Investment

For higher interest, longer term investments with options of 90 days, 6 months, 1 year and 2 years.

- Attractive interest rates

- You can choose to have interest paid at maturity or annually for investments longer than 12 months

- Minimum investment is $5,000

Minister’s Expense Account (MEA)

An Easy Access style fee-free* everyday account that can have cheque, BPAY, direct entry and online access (via CCFS Online). The operations of this account are required to be in accordance with the Recommended Terms and Conditions of Employment of Ministers document.

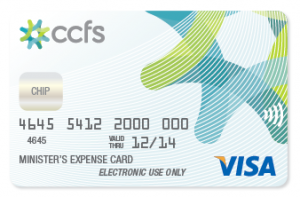

Minister’s Expense Card (MEA Visa)

A prepaid Visa Card for Ministers’ Exempt Fringe Benefits. These cards can be topped up online via EFT and because they are affiliated with Visa, can be used for purchases overseas, online or anywhere Visa is accepted. A Product Disclosure Statement (PDS) can be downloaded here and the Financial Services Guide (FSG) can be downloaded here. Alternatively, they can be obtained by contacting the CCFS office. It is important to consider the PDS and FSG when deciding whether the MEA Visa is appropriate for your Ministry staff.

A prepaid Visa Card for Ministers’ Exempt Fringe Benefits. These cards can be topped up online via EFT and because they are affiliated with Visa, can be used for purchases overseas, online or anywhere Visa is accepted. A Product Disclosure Statement (PDS) can be downloaded here and the Financial Services Guide (FSG) can be downloaded here. Alternatively, they can be obtained by contacting the CCFS office. It is important to consider the PDS and FSG when deciding whether the MEA Visa is appropriate for your Ministry staff.

Please note: The Minister’s Expense Card (MEA Visa) is issued by Indue Ltd ABN 97 087 822 464 AFSL 320206 (Head Office located in Brisbane). CCFS is an agent of Indue for distribution of the Card. This page may contain general advice. It does not take account of your personal objectives, circumstances or needs. Consider its appropriateness before acting on it. Read the Product Disclosure Statement or terms and conditions as well as the Target Market Determination available by clicking here before deciding.

Long Service Leave (LSL) Accumulator Account

Ministers and employee’s entitlements represent a significant component of their remuneration. For churches and agencies, these entitlements represent a liability that must be reliably funded and paid out at some time in the future. In this regard, ministers and employees seek tangible assurances that their entitlements are secure and as good stewards, churches want to give these assurances.

CCFS provides the solution, with a structure for funding and securing minister and employee entitlements that is independent and unexposed to the financial position of the church. For more information refer to the Useful Information section of the Resources page on this website.

Interest Offset Account

Available for churches, departments and affiliated organisations that have surplus funds but don’t want to use those funds to reduce the loan balance. Surplus funds can be deposited in this offset account at a higher interest rate, with the interest on these surplus funds offset against the loan interest.

CCFS Online ‘Business Banking’ Facility

CCFS Business Banking provides churches and organisations with the opportunity to transact online with enhanced security features that allow multiple authorisers. ‘Business Banking’ is available through the CCFS website Online Access portal with all the usual online functionality including BPAY, EFT and viewing account information such as balances and account transaction history. Contact information can also be updated online.

Merchant Facilities

CCFS has entered into partnership with a major Australian Bank to provide Churches and related organisations with the option of receiving payments and offerings via EFTPOS. Terminals can be either fixed (landline) or mobile (utilising Telstra’s 4G network). Our partnership has resulted in discounted pricing, reduced paperwork and less onerous eligibility criteria. Now your church or organisation is able to receive payments and offerings anywhere, increasing convenience and hopefully boosting donations.

BPAY

BPAY is a bill payment service that enables you to pay your bills day or night, through internet banking. Paying bills with BPAY couldn’t be much easier. That’s why on average, over 4 million payments are made through BPAY every week. BPAY gives you total control of your payments. You can pay one-off bills including telephone, electricity and gas on the internet or schedule payments for later. It’s easy and convenient. To view a full listing of BPAY billers visit bpay.com.au

To pay with BPAY follow these simple steps:

-

Look for the distinctive BPAY logo on your bills .

-

Login to CCFS Online or call 1300 MY CCFS (1300 69 22 37)

-

Select the BPAY or bill payment option and follow the simple instructions.

* These accounts do not attract any regular account keeping fees however, any third party fees (such as dishonour fees) will still apply.